Net Salary Meaning Example

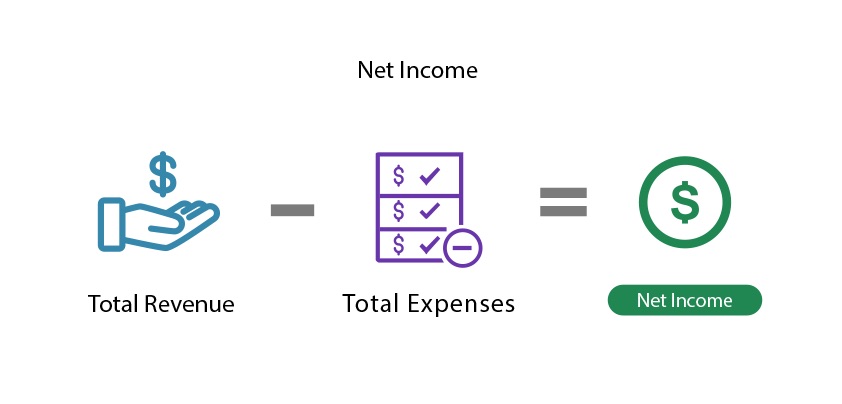

Net salary is the amount of take-home pay remaining after all withholdings and deductions have been removed from a persons salary. Net pay is the final amount of money that you will receive after all taxes and deductions have been subtracted.

Salary Formula Calculate Salary Calculator Excel Template

A persons salary after taxes insurance etc.

Net salary meaning example. Translations in context of net salary in English-Spanish from Reverso Context. Examples of Net Pay. Any reimbursements bonuses or other payments would also be added to gross pay.

A salary is the regular payment by an employer to an employee for employment that is expressed either monthly or annually but is paid most commonly on a monthly basis especially to white collar workers managers directors and professionals. For example if you earn 1000 per month that would be your gross wages. What does salary mean.

A salary employee or salaried employee is paid a fixed amount of money each month. The deductions that can be taken from gross pay to arrive at net salary include but are not limited to the following. A fixed amount of money paid to a worker usually measured on a monthly or annual basis not hourly as wages.

The residual amount is then paid to the employee in cash. This includes everything and deducts all the taxes and other retirement benefits. Gross salary is the maximum amount of the salary inclusive of all taxes.

In this example the deductions have been made from the employees salary on account of state tax federal tax contribution to the retirement plan and contribution to the insurance plan. Take-home pay known as in-hand salary in India is the net salary after deducting income tax TDS tax deducted at source in India and other deductions from the gross monthly pay. The company provided permanent health insurance that would pay 80 of a persons net salary after six months of.

A persons salary after taxes insurance etc. Retirement Benefits eg 401k benefits Income Tax which deducts at source Shift Allowance Free Meals if any. Gross salary meaning and examples.

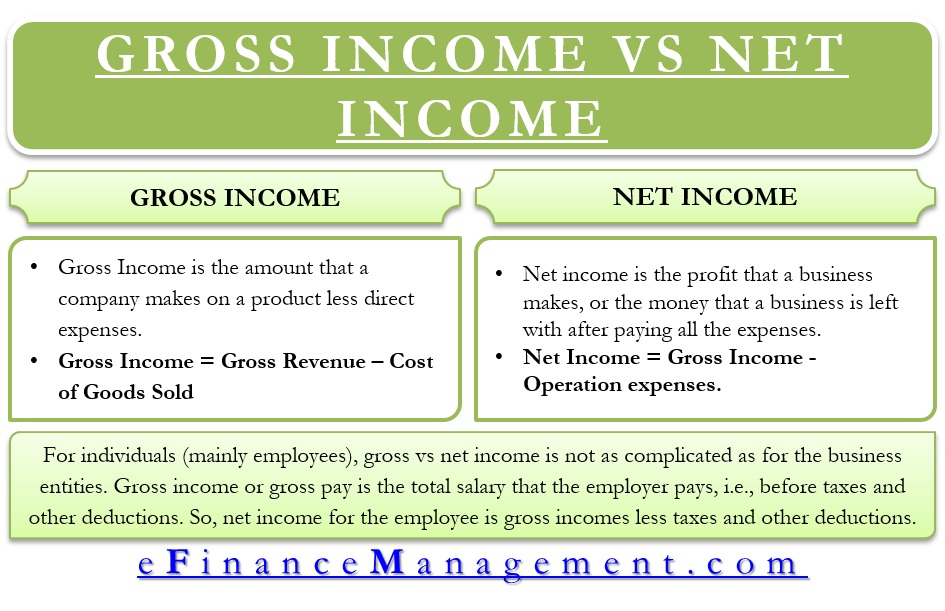

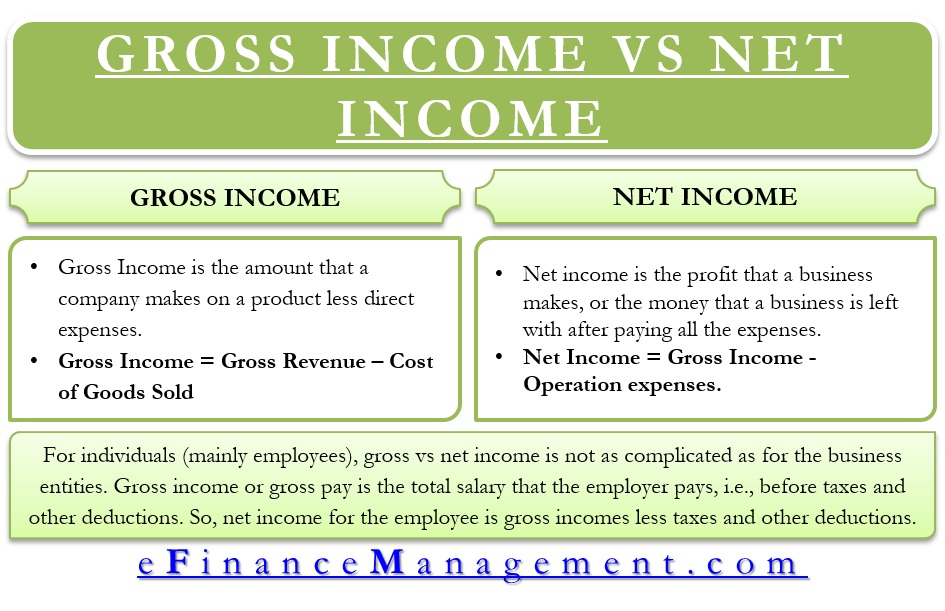

Gross Salary is the amount employee earns in the whole year span of time without any deduction. What Is the Difference Between Net Pay and Gross Pay. Net Salary is Income Tax deductions Public Provident Fund and Professional Tax subtracted from gross salary which means Net Salary Gross Salary - Income Tax - Public Provident Fund - Professional Tax.

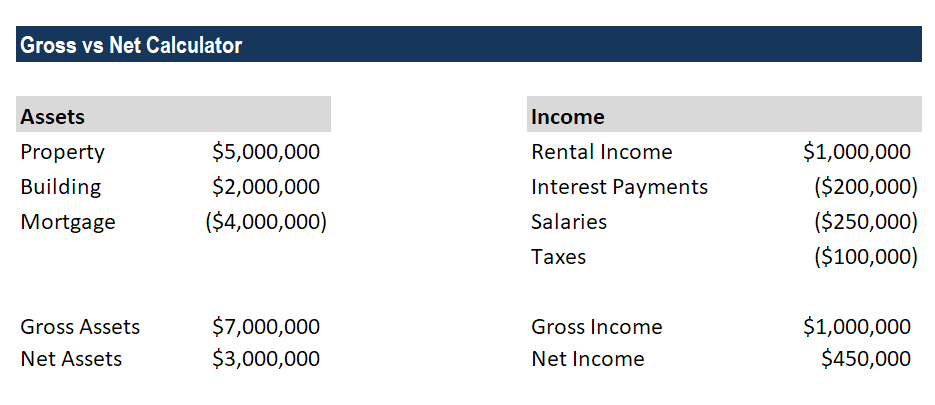

The total deductions amount to 720. For example a salaried employee who makes 40000 per year is paid by dividing that 40000 by the number of pay periods in a year. In the example the employee would receive 26 paychecks that each total 153846.

Net Salary is the salaried employees net amount after deduction Income Tax PPF Professional Tax. Your gross salary is the wages you get before they take out all of your withholding amounts. Your net salary is what you actually receive.

Way too many people think they understand the difference between net and gross so the difference between net income and gross income the difference between. Net Salary is the actual take away home salary that an employee gets in its bank account. For example if your employer agreed to pay you 15 per hour and you work for 30 hours during a pay period your gross pay will be 450.

After they take out federal and state withholding along with Fica Medicare and disability the amount you actually receive is call net salary. People put them on their Facebook profile as though they are meaningul you even know your Chinese horoscope as well. Use Take Home Salary Calculator India to make a decision of accepting the new job offer or not by looking at your monthly in-hand earnings and deductions.

Let us understand the calculation with the help of examples. Gross Pay Although many people equate salary with gross pay the two terms are distinct Salary refers to the agreed-upon earnings that an employer will give a worker in a given period of time Salary is only calculated as the standard base pay rate or hourly earnings and it does not include any extra money. Reverso Context oferă traducere în context din engleză în română pentru meaningul cu exemple.

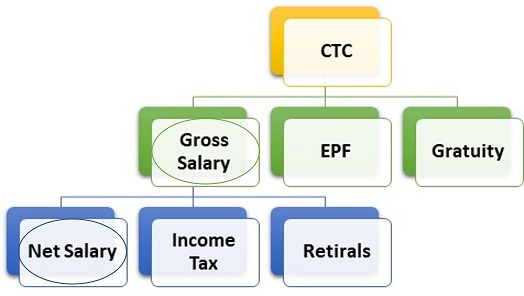

Salary Net Salary Gross Salary Cost To Company What Is The Difference

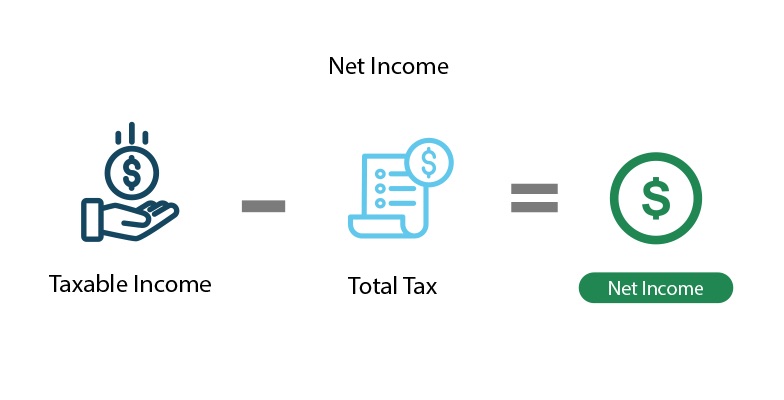

Net Income Example Formula Meaning Investinganswers

Gross Salary Vs Net Salary Top 6 Differences With Infographics

What Is Net Income Definition Formula And How To Calculate

Salary Formula Calculate Salary Calculator Excel Template

Gross Vs Net Learn The Difference Between Gross Vs Net

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

Salary Formula Calculate Salary Calculator Excel Template

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

What Is Gross Income Business Gross Income Individual Gross Income Mageplaza

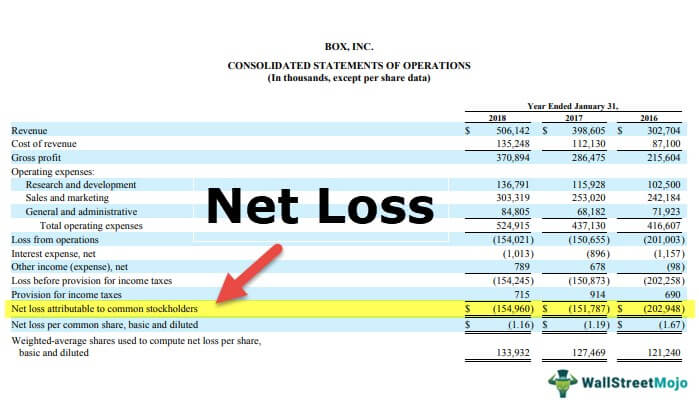

Net Loss Definition Formula Calculation Examples

Net Income The Profit Of A Business After Deducting Expenses

Net Salary Definition Importance Example Human Resources Hr Dictionary Mba Skool Study Learn Share

What Is Basic Salary Definition Formula Income Tax Exceldatapro

Difference Between Gross Income Vs Net Income Definitions Importance

Annual Income Learn How To Calculate Total Annual Income

Net Income Example Formula Meaning Investinganswers

:max_bytes(150000):strip_icc()/Paycheck_AdobeStock_154492502_Editorial_Use_Only-b62ac70013ec4e13b3e2a73be5e9c239.jpeg)

:max_bytes(150000):strip_icc()/AppleIncomeSattementDec2019-cd967d0a8f5e4748a1060f83a7e7acbc.jpg)

Post a Comment for "Net Salary Meaning Example"