Monthly Salary Calculator Texas

See how your monthly payment changes by. Projected Monthly Child Support Obligation for net resources up to 9200.

Free Online Paycheck Calculator Calculate Take Home Pay 2021

So if you earn 10989 per hour your annual salary is 20000000 based on 1820 working hours per year which may seem a lot but thats only 1517 hours per month or 35 hours per week and your monthly salary is 1666667.

Monthly salary calculator texas. The Texas Minimum Wage is the lowermost hourly rate that any employee in Texas can expect by law. One of a suite of free online calculators provided by the team at iCalculator. This free easy to use payroll calculator will calculate your take home pay.

This breakdown will include how much income tax you are paying state taxes federal taxes and many other costs. Use this free Texas Mortgage Calculator to estimate your monthly payment including taxes homeowner insurance principal and interest. For the purposes of this calculator bi-weekly payments occur every other week though in some cases it can be used to mean twice a week.

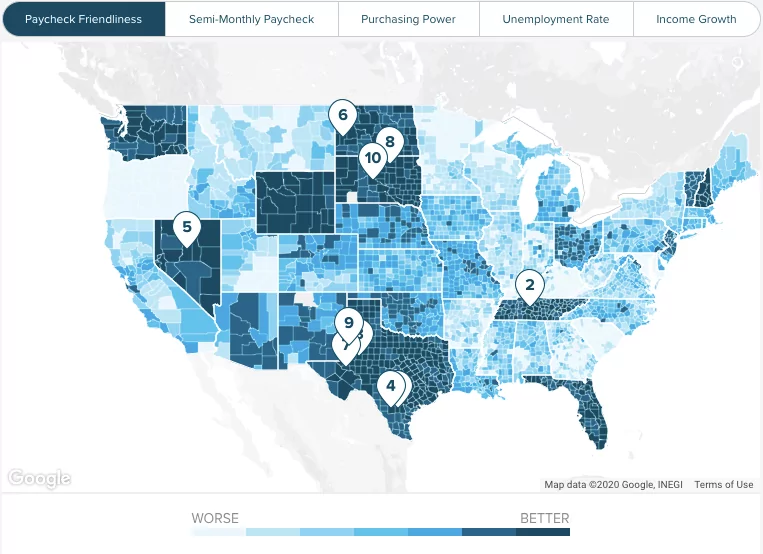

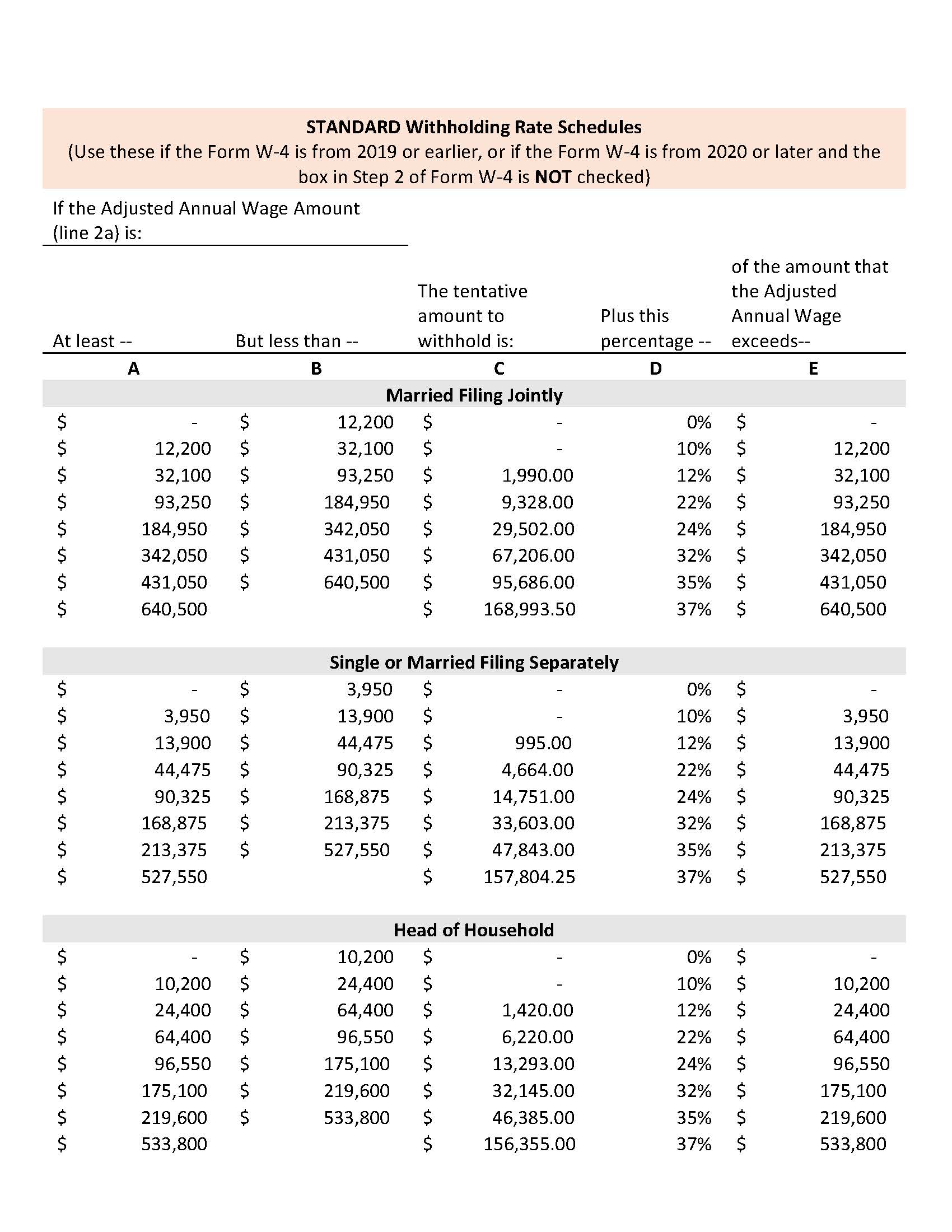

There are legal minimum wages set by the federal government and the state government of Texas. The adjusted annual salary can be calculated as. To better compare withholding across counties we assumed a 50000 annual income.

This marginal tax rate means that your immediate additional income will be taxed at this rate. If you are paid an even sum for each month to convert annual salary into monthly salary divide the annual salary by 12. This calculator does not calculate support in excess of the 9200 net resource amount per Texas Family Code sec.

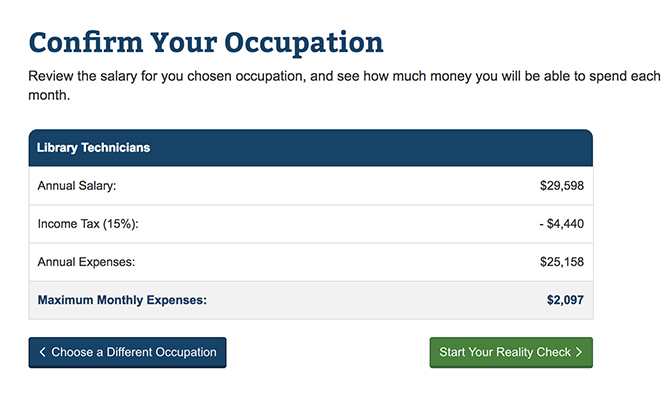

Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in Texas. The Salary Calculator tells you monthly take-home or annual earnings considering UK Tax National Insurance and Student Loan. To use our Texas Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button.

That means that your net pay will be 45705 per year or 3809 per month. Supports hourly salary income and multiple pay frequencies. Calculate your Texas net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Texas paycheck calculator.

Salaries below this are outliers. The federal minimum wage is 725 per hour and the Texas state minimum wage is 725 per hour. First we calculated the semi-monthly paycheck for a single individual with two personal allowances.

Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Calculates Federal FICA Medicare and withholding taxes for all 50 states. Why not find your dream salary too.

17278 - 23479 8 of jobs 27024 is the 25th percentile. Salaries above this are outliers. In order to determine an accurate.

Management 104136 Business Financial Operations 72237. The latest budget information from April 2021 is used to show you exactly what you need to know. The Texas Salary Calculator allows you to quickly calculate your salary after tax including Texas State Tax Federal State Tax Medicare Deductions Social Security Capital Gains and other income tax and salary deductions complete with supporting Texas state tax tables.

If you make 55000 a year living in the region of Texas USA you will be taxed 9295. The Guidelines for the support of a child are specifically designed to apply to monthly net resources not greater than 9200. 23480 - 29681 36 of jobs 29682 - 35884 19 of jobs The average salary is 36650 a year.

Check out our new page Tax Change to find out how. Also a bi-weekly payment frequency generates two more paychecks a year 26 compared to 24 for semi-monthly. Overview of Texas Taxes Texas has no state income tax which means your salary is only subject to federal income taxes if you live and work in Texas.

Your average tax rate is 169 and your marginal tax rate is 297. 23 lignes Typical Annual Salary. Well do the math for youall you need to do is enter the applicable information on salary federal and state W-4s deductions and benefits.

Using 10 holidays and 15 paid vacation days a year subtract these non-working days from the total number of working days a year. See how we can help. Use our calculator to discover the Texas Minimum Wage.

Using our Texas Salary Tax Calculator. If you are paid in part based on how many days are in each month then divide your annual salary by 365 or 366 on leap years then multiply that number by the number of days in the month to calculate monthly salary. 30 8 260 - 25 56400.

We applied relevant deductions and exemptions before calculating income tax withholding. While a person on a bi-weekly payment schedule will receive two paychecks for ten months out of the year they will receive three paychecks. Base Monthly Salary in Texas.

After a few seconds you will be provided with a full breakdown of the tax you are paying. 35885 - 42086 6 of jobs 44302 is the 75th percentile. Hourly rates weekly pay and bonuses are also catered for.

The following is the salary conversion table that shows the hourly weekly monthly and annual salaries for hourly rates ranging from 1 to 100. We then indexed the paycheck amount for each county to reflect the counties with the lowest withholding burden or greatest take. All bi-weekly semi-monthly monthly and quarterly.

42087 - 48288 17 of.

Texas Paycheck Calculator Smartasset

This Is How Much Money You Save On H1b L1 Visa In Us 2021

Texas Paycheck Calculator Smartasset

New Tax Law Take Home Pay Calculator For 75 000 Salary

Gross Pay And Net Pay What S The Difference Paycheckcity

Rhode Island Paycheck Calculator Smartasset

Calculate Child Support In Texas Reach Agreements On Child Support Mediation

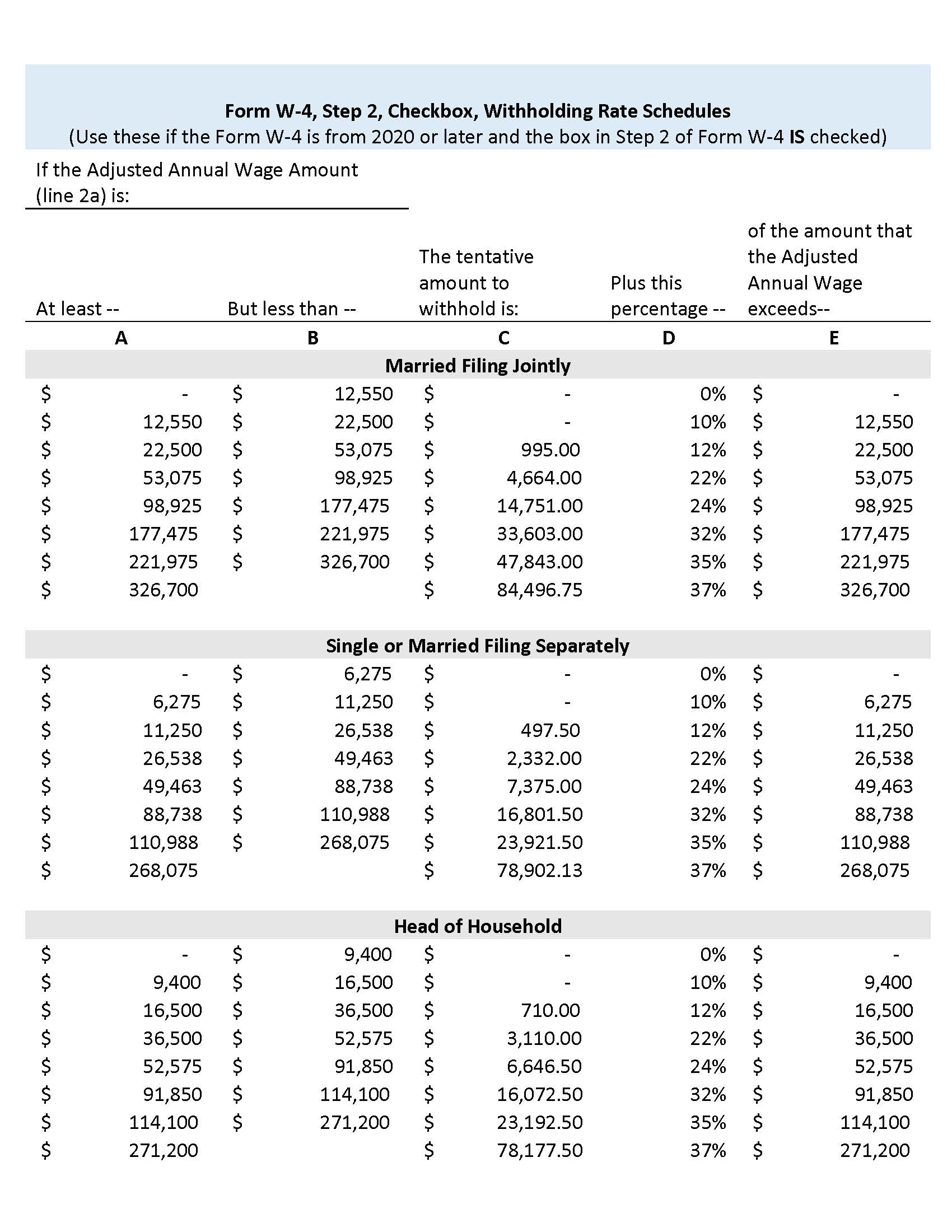

Calculation Of Federal Employment Taxes Payroll Services The University Of Texas At Austin

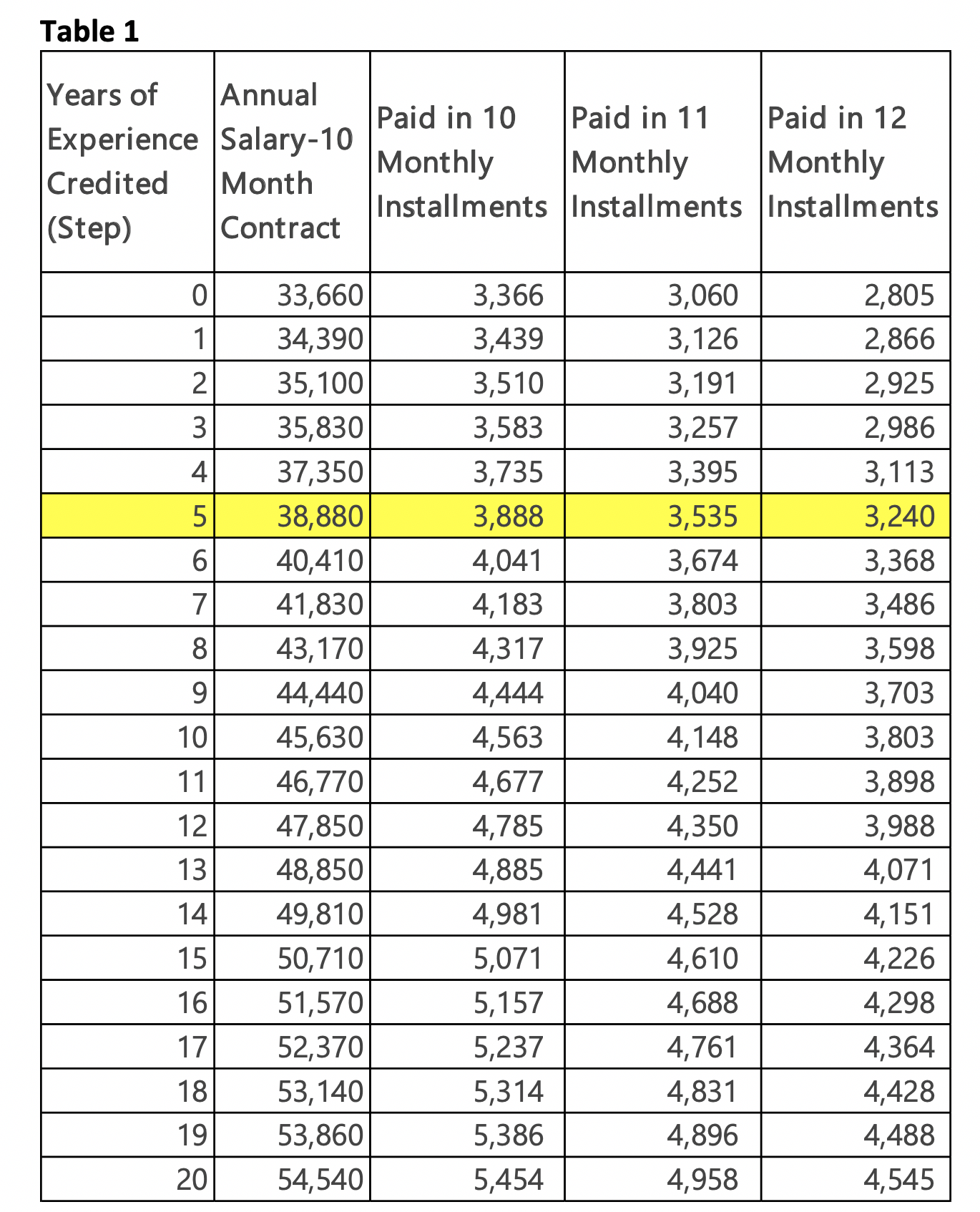

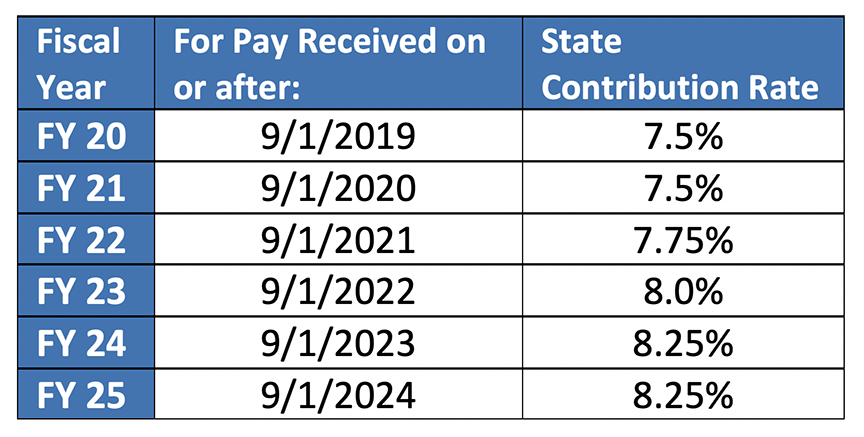

Contribution To Trs New Minimum Salary Schedule Increase Charter School Success

Gross Pay And Net Pay What S The Difference Paycheckcity

Contribution To Trs New Minimum Salary Schedule Increase Charter School Success

Texas Teacher Salary Increase Pursuant To House Bill Hb3 Educatio

Paycheck Calculator Salaried Employees Primepay

Texas Child Support Calculator 2020 How To Calculate Child Support In Texas

Calculation Of Federal Employment Taxes Payroll Services The University Of Texas At Austin

Payroll Software Solution For Texas Small Business

Texas Paycheck Calculator Smartasset

Paycheck Calculator Take Home Pay Calculator

,%20%20How%20to%20Calculate%20Child%20Support%20in%20Texas.PNG)

Post a Comment for "Monthly Salary Calculator Texas"