13th Month Pay Taxable Or Nontaxable

Is 13th month pay taxable. 10963 or the TRAIN law on January 2018.

Philippines Understanding Taxation Of 13th Month Pay And Christmas Bonuses In The Philippines Asean Economic Community Strategy Center

Under current law or Republic Act 10653 the 13th month pay and other benefits including productivity incentives and Christmas bonuses are exempted from tax if they do not exceed P82000.

13th month pay taxable or nontaxable. Before RA 10653 was signed into law in 2015 only bonuses not exceeding P30000 were tax-exempt. Under a law passed by the previous Congress and signed by then president Benigno Aquino III annual bonuses of up to P82000 are exempt from income tax. Any amount paid in excess of the threshold is considered taxable income.

13th Month Pay for Resigned or Terminated Employees. Any amount in excess thereof may be subjected to tax. 8424 the benefit must not exceed P30000.

12 NON-TAXABLE COMPENSATION INCOME OF GOVERNMENT EMPLOYEES THAT EVERY ACCOUNTANT SHOULD KNOW TO AVOID COMMITTING ERRORS IN THE COMPUTATION OF THEIR INCOME TAX. Where an employee resigns or is terminated from their employment at any time during the year the employee is still entitled to receive a 13th Month Pay benefit but based only on the number of months the employee was employed during the year and salary paid. Typically each bonus is based on.

13th-month payalso sometimes referred to as the 13th-month bonus 13th-month salary or thirteenth salaryis a monetary benefit that is either mandatory by law or customary for the countries that participate. Since the 13th-month pay is in the nature of a bonus our tax rules provide that the first PHP90000 received by an employee during the calendar year is exempt from income tax. From the foregoing it can be said that the 13th month pay of employees is not taxable.

View Nontaxablepptx from MATH 105 at University of St. 13th-month pay is non-taxable. Yes it is not taxable provided that the sum received is less than Php 8200000.

This is computed pro-rata according to the number of months within a year that an employee has worked with an employer. Any company that hires employees internationally is required to comply with the host countrys employment and compensation laws and labor rights. La Salle - Bacolod City.

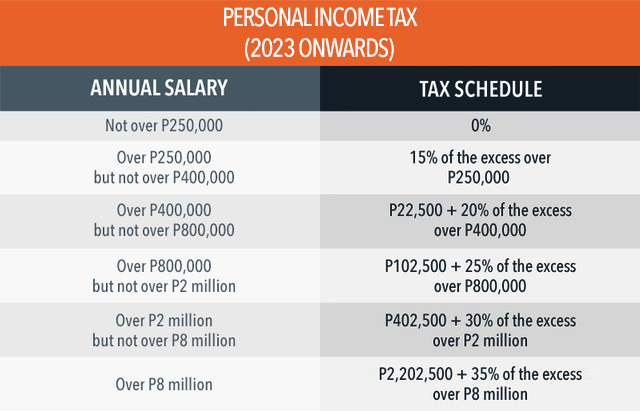

Courtesy of the TRAIN Law this amount is relatively higher as compared to last years tax. Under the TRAIN Law 1 the 13th-month pay and other benefits received by an employee not exceeding Php 90000 are excluded from the computation of gross income and thus exempt from taxation. 13th month pay is taxable if it exceeds PHP 90000.

The amendment stipulates that the 13th month pay and other equivalent benefits shall not be subject to tax for a maximum of P90000. Is 13th month pay taxable or non taxable. However there is a prescribed limit to this exemption provided under Section 32 B7e of the National Internal Revenue Code NIRC which was amended by Republic Act No.

Tamang sagot sa tanong. Private sector workers get. Under Section 32B Chapter VI of R.

NON-TAXABLE Non-taxable wages are wages given to an employee or individual without any taxes withheld. Otherwise it is taxed. The 13th month pay is generally exempt from taxation.

This one is partly true and partly not. 1 on a question Is 13th month pay taxable or non taxable. Thirteenth 13th Month Pay Year-End Bonus and Other Benefits not exceeding Ninety Thousand Pesos P9000000 paid or accrued during the year.

The 13th month pay is equivalent to 112 of the basic salary of an employee within a calendar year. Any amount exceeding Ninety Thousand Pesos P9000000 are taxable. Hence if you receive a 13th-month pay amounting to more than Php 90000 the excess of said amount is included in your gross income and shall be taxable.

However there is a limit as to the maximum amount of the 13th month pay which is exempt from tax. 9 lignes But before you consider it being taxable under normal income tax rate or fringe benefit tax you. This new amount is a relative increase from the previous tax.

13th Month Pay An Employer S Guide To Monetary Benefits

Expats Guide To 13th Month Pay And Christmas Bonus Philippine Primer

Philippines Understanding Taxation Of 13th Month Pay And Christmas Bonuses In The Philippines Asean Economic Community Strategy Center

Welcome To The Withholding Tax System The Withholding

Tax Calculator Compute Your New Income Tax

How To Compute Your 13th Month Pay In 2018

Seychelles Revenue Commission Income And Non Monetary Benefits Tax

Withholding Tax On Compensation Revenue Regulations No 2

13th Month Pay An Employer S Guide To Monetary Benefits

13th Month Pay In The Philippines Obligations For Employers Cloudcfo

13th Month Pay An Employer S Guide To Monetary Benefits

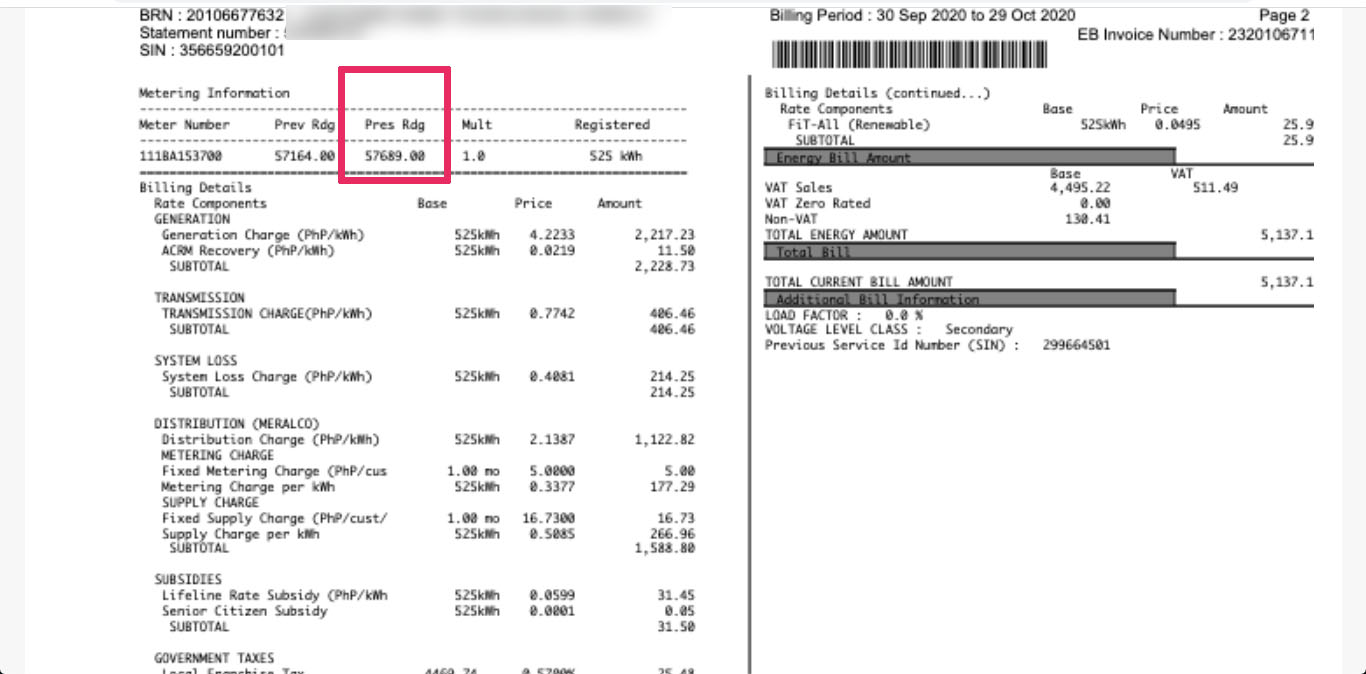

How To Compute Your 13th Month Pay Income Tax Meralco Bill Other Bayarin Pep Ph

A 13th Month Pay Guide For Employees

13th Month Pay An Employer S Guide To Monetary Benefits

Tax Exemptions And De Minimis Benefits

Withholding Tax On Compensation Revenue Regulations No 2

Everything You Need To Know About 13th Month Pay Sunstar

Post a Comment for "13th Month Pay Taxable Or Nontaxable"